Despite What Insurers and Pharmacy Benefit Managers Say, Protecting Patient Assistance Programs Has Not Increased the Cost of Health Insurance

State Laws Protecting Patient Assistance Programs by Prohibiting Accumulators and Maximizers Have Not Impacted Health Insurance Premiums

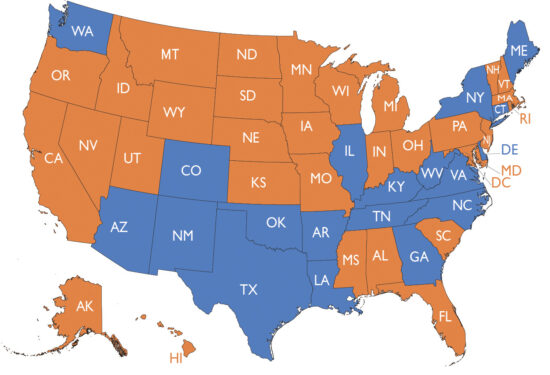

Nineteen states*, shown in blue, have passed laws to protect patient assistance programs. These laws ban accumulators and maximizers. Insurance companies and pharmacy benefit managers oppose these laws, saying they will increase health insurance costs (premiums).

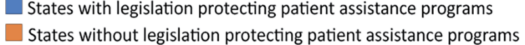

Our analysis shows this has not been the case, even with more states banning accumulators and maximizers. As shown on the graph, the rates of change (the slope or steepness of changes in each line) in health insurance costs were not different in states with (blue line) vs without (orange line) bans on accumulators and maximizers. Use our interactive tool below to view how a state compares to these averages and to other states. Although a state may have average premiums that are higher or lower than the overall averages, the rates of increases and decreases have been similar for all states.

To fully understand the issue, it is helpful to define some health insurance terms.

- Co-pays and co-insurance are a share of costs for healthcare services that patients are obligated to pay (even when their insurance is also paying part of healthcare costs).

- Deductibles are pre-set dollar amounts patients must pay before insurance pays for anything (except for some preventive care).

- Out-of-pocket (OOP) maximums are the amounts patients pay each year–including deductibles, co-pays, and co-insurance–before the insurance covers all additional costs.

- Patient assistance programs, usually funded by drug companies, give financial assistance to patients who cannot afford their medicine.

Accumulators and maximizers stop patient assistance from counting toward a patient’s deductible and out-of-pocket maximum. This means the insurer or pharmacy benefit manager is receiving the benefit of assistance, not the patient.

- Accumulators stop assistance from counting toward a patient’s deductible and out-of-pocket maximums.

- Maximizers set out-of-pocket maximums equal to the maximum value of assistance, usually spread evenly throughout the year. Maximizers also stop assistance from counting toward a patient’s deductible and out-of-pocket maximum.

In June 2022, we demonstrated that banning accumulators and maximizers had not increased the cost of health insurance. Since then, six more states have passed laws protecting patient assistance. Another year of health care costs also became available. Passing laws that protect patient assistance by banning accumulators and maximizers still has not led to increased insurance costs.

Use the tool below to see insurance cost changes in specific states since 2014 in comparison to the average change for states that have (blue) or have not (orange) protected patient assistance programs.

*As of June 2023

Use This Interactive Tool to Explore Health Care Premium Cost Trends State by State

Averages across states are based on the year the legislation went into effect (as shown in labels) , which is often later than the year it passed. This ensures that the averages were not artificially lowered by including premium cost changes before effects of legislation.

NOTE: missing data points reflect that no data for that state was available for the year in question (for example, there is no data for Hawai’i in the bronze tier); when this occurred, the state was not included in calculating the average for that tier and year.

Raw data was taken from the HIX compare + website (www.hixcompare.org), sponsored by the Robert Wood Johnson Foundation, which provides data for most health insurance policies available through the Affordable Care Act (ACA) Healthcare Marketplace at Healthcare.gov.

We created two separate databases when calculating average health insurance premiums: health insurance available to 1) individual purchasers and 2) small group purchasers. This analysis matches the availability of data from HIX compare +. For plans available to individual purchasers, each state’s average premium for each insurance metal tier for every year from 2014 to 2023 was calculated and recorded for an individual adult and for a family of two adults and two dependents. For plans available to small group purchasers, the same averages were recorded for the years 2014 to 2022. Data for 2023 is not yet available for insurance available to small group purchasers and will be updated as it becomes available.

Averages were calculated as the sum of the health insurance premiums for all plans in a specific tier in a particular state divided by the number of available health plans for that tier in that state. The percent rate of change in these averages was calculated as follows.

2016 to 2017 (example) Year Over Year Change = (2017 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 −2016 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 / 2016 𝑃𝑟𝑒mi𝑢𝑚)×100

Changes in the magnitude of the percent rate change in average premiums were compared as raw percentages and analyzed with repeated ANOVA measures to evaluate whether rate changes were significantly different from one year to the next. The repeated ANOVA test is appropriate for multiple measurements of the same variable over time concerning a change assumed to have a direct non-random relationship with another variable. In this case, the repeated measure is the average health insurance premium. The second variable is the introduction of legislation relating to the prohibition of accumulators and/or maximizers impacting patient assistance programs. ANOVA analysis also allows for incorporating a spline function that can determine if a specific event (such as the enactment of legislation) had a statistically significant impact on changes in the rate of increase or decrease in premium prices. The null hypothesis was that there is no correlation between the rate of increase/decrease in the average premium price and the implementation of co-pay accumulator and maximizer prohibition.

DEFINITIONS

Accumulator: a clause in some health insurance policies that excludes the value (dollar amount) of support from patient assistance programs counting toward an insured person’s annual deductible and maximum out-of-pocket obligations.

Adult: For the purposes of this research we used the HIX data for the average healthcare insurance premiums for a single person, age 27 or more as the average rate for a single adult. Rates for single adults of different ages will vary around this average.

Affordable Care Act (ACA) Healthcare Marketplace: a shopping and enrollment service for medical insurance created by the Affordable Care Act in 2010. This service is available online or by phone and managed by Federal or State governments.

Co-insurance: often a percentage of a bill for health care services or prescriptions that the insured person or policy holder owes after they have paid their deductible and until they have paid their out-of-pocket maximum amount.

Co-pay: a fixed amount of money paid by an insured person for specific covered health services and prescriptions. Copays at times may not count toward the insured person’s deductible and are owed by the insured individual and policy holder until they have spent their out-of-pocket maximum on health care expenses.

Deductible: a set dollar amount an insured person or policy holder is required to pay toward covered medical expenses within a single year before health insurance begins paying for any portion of health care expenses, with the exception of some preventive care that is paid by the insurance before the deductible is met.

Family: For the purposes of this research we used the HIX data for the average healthcare insurance premiums for two adults with dependents under age 26. Rates for families with different numbers of adults and dependents will vary around this average.

Health insurance: a program for purchase that helps the purchaser (the policy holder) pay for medical services and prescriptions for themselves and dependent family members. The buyer (insured) and the seller (insurance) each agree to pay amount toward medical expenses.

Health insurance policy: the written agreement that details what amounts or portions of medical or pharmacy costs will be paid by the insured (buyer of the policy) and the insurance (seller of the policy) toward specific medical expenses.

Health insurance premium: the amount paid by an insured person to purchase a health insurance policy for themself and any of their dependents (spouse and children usually). Premiums are charged every year and usually paid in 12 monthly installments.

Employee health insurance premium: People who receive health insurance sponsored by their employer share the cost of premiums with the employer, and their share is typically deducted from their paycheck.

Individual purchaser: a person who buys their own insurance policy for themself and their dependents and pays the entire cost of premiums with no involvement of employers or other organizations. Some individual purchasers are eligible for government rebates or subsidies for purchase of health insurance.

Maximizer: a clause in a health insurance policy that sets out-of-pocket costs equal to the maximum value of a patient assistance program, typically applied evenly throughout the benefit year. Such payments are excluded from the patient’s annual deductible and maximum out-of-pocket obligations.

Metal tier: different categories of health insurance defined by the portion of health care costs paid for by the insured and the insurance, with the insured individuals portion decreasing as the category goes from bronze to silver to gold to platinum. Refers only to how costs are shared and not to quality of care provided.

Out-of-pocket maximum: the most an insured person or policy holder has to pay for covered health care services in a plan year. After this amount is spent on deductibles, copayments, and coinsurance the health plan pays 100% of the costs of covered benefits.

Patient assistance: programs that provide financial assistance (discounts or subsidies) to people who can not afford the cost of the prescription medicine(s) the company produces. These programs are offered by pharmacy organizations, non-profit foundations, state governments, and pharmaceutical companies. When sponsored by a company, the assistance is only for the drugs produced by that company.

Pharmacy benefit managers (PBMs): companies that negotiate what insurance companies will pay pharmacies and pharmaceutical companies for drugs, including discounts and rebates. PBMs often are also responsible for establishing formularies (list of which drugs insurance will or will not cover) and processing and paying bills for prescription drugs. PBMs also own specialty pharmacies that dispense medicines.

Policy holder: the individual who purchased the insurance for themself or their dependents, even if the purchase was paid for, in part, by their employer or another organization.

Small group purchaser: organizations with fewer than 50 employees or members that may purchase a policy on behalf of the employees or members. Often the organization or employer pays a portion of the cost and deducts the policy holder’s share remaining share of the premium from their pay or dues.

HELP FINDING PATIENT ASSISTANCE PROGRAMS

Needy Meds is a clearinghouse of patient assistance programs that can help you find assistance paying for medications. We also recommend identifying the manufacturer of the medication you need and visiting their website to search for available patient assistance programs.

ADDITIONAL RESOURCES

CreakyJoints Staff. State Laws Protecting Patient Assistance Programs (PAP) Help Patients, Without Hiking Insurance Premiums. CreakyJoints. 2023. Accessed July 31, 2023. https://creakyjoints.org/living-with-arthritis/treatment-and-care/navigating-healthcare/protecting-patient-assistance-programs/

Dickson SRGabriel NGellad WFHernandez I. Assessment of Commercial and Mandatory Discounts in the Gross-to-Net Bubble for the Top Insulin Products From 2012 to 2019. JAMA Netw Open. 2023;6(6):e2318145. doi:10.1001/jamanetworkopen.2023.18145

Popovian R, Smith W. The World’s Most Unethical Companies. DC Journal. Inside Sources. 2023. Accessed July 31, 2023. https://dcjournal.com/the-worlds-most-unethical-companies/

Popovian R., Tharp L. It Is Time For Policymakers To Protect Patients From Predatory Practices Of Insurers And PBMs. Healthcare Business Today. 2023. Accessed July 31, 2023. https://www.healthcarebusinesstoday.com/it-is-time-for-policymakers-to-protect-patients-from-predatory-practices-of-insurers-and-pbms/

Smith W, Popovian R, Winegarden W. Out-of-Pocket Pirates: Pharmacy Benefit Managers (PBMs) and the Confiscation of Out-of-Pocket Assistance Programs. Pioneer Institute. 2023. Accessed August 2, 2023. https://pioneerinstitute.org/wp-content/uploads/PNR-519-Maxminimizers-WP-v01.pdf

Wanneh, G. CMS Rejects Call To Ban Copay Accumulators In Draft 2024 Exchange Rule. Inside Health Policy. 2022. Accessed July 31, 2023. https://insidehealthpolicy.com/daily-news/cms-rejects-call-ban-copay-accumulators-draft-2024-exchange-rule

Zuckerman AD, Schneider MP, Dusetzina SB. Health Insurer Strategies to Reduce Specialty Drug Spending—Copayment Adjustment and Alternative Funding Programs. JAMA Intern Med. 2023;183(7):635–636. doi:10.1001/jamainternmed.2023.1829

Esteban Rivera, MS; Anne M. Sydor, PhD; and Robert Popovian, PharmD, MS

Global Healthy Living Foundation Patient-Centered Economic and Policy Research

For questions or to learn more, contact Robert Popovian, Chief Science Policy Officer at [email protected].